The Department Nobody Puts in RevOps (And Why That’s Costing You)

RevOps is supposed to give you a complete picture of your revenue. So why does everyone keep cutting the picture in half?

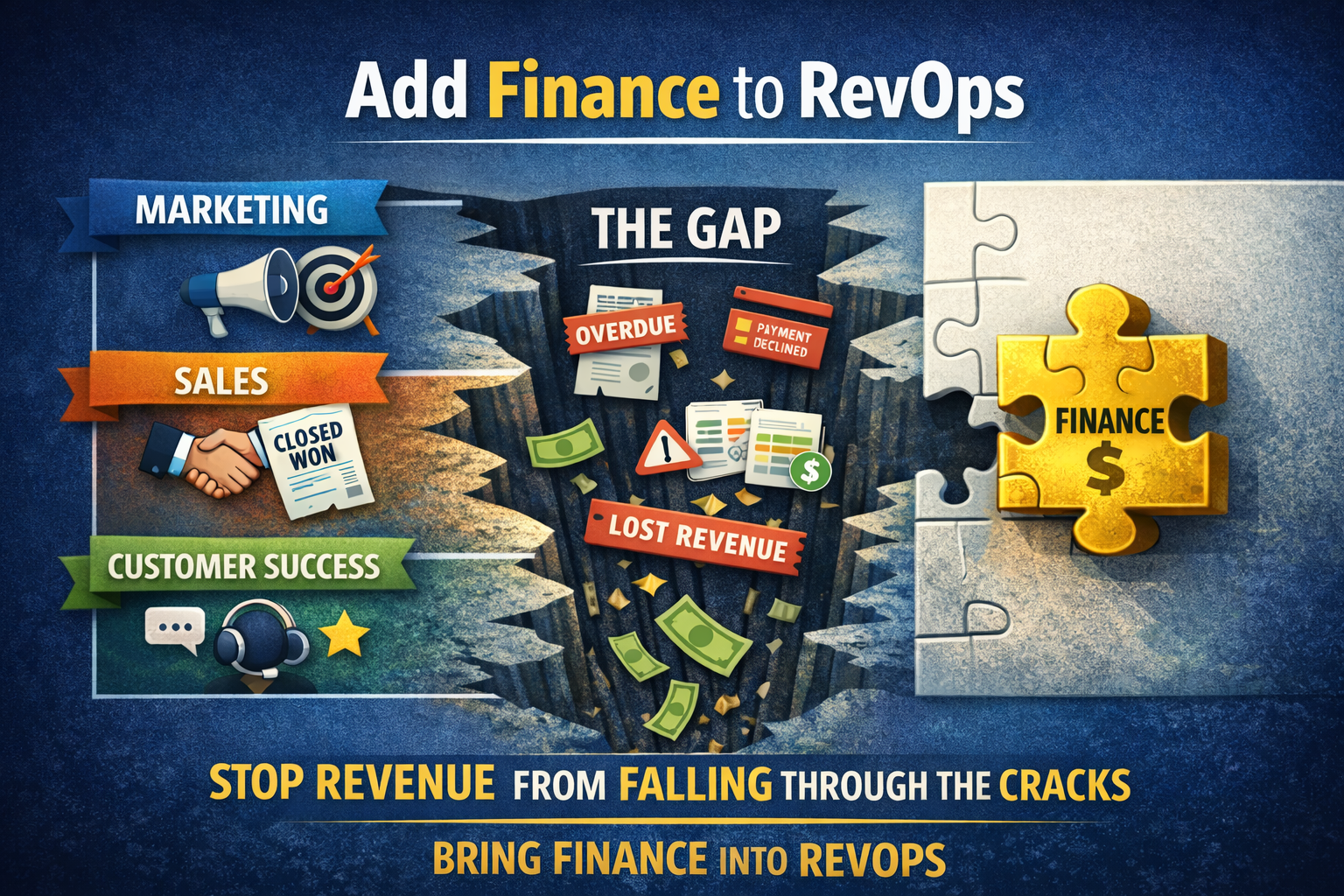

Here's the version of RevOps that most consultancies will sell you: Marketing generates leads. Sales closes them. Customer Success retains them. Three departments, aligned, sharing data, singing from the same hymnal. RevOps achieved. Pop the champagne.

Except nobody's checking whether the champagne actually got paid for.

The Missing Piece

We have a position at Alternative Partners that puts us in the minority, and we're comfortable with that: Finance belongs inside RevOps. Not downstream from it. Not adjacent to it. Inside it.

The standard RevOps framework stops at "Closed Won." Contract signed. Handshake emoji in Slack. On to the next deal. But between a signed contract and cash hitting your bank account, there's a gap — and that gap is where revenue goes to quietly die.

A signed contract isn't revenue. It's a promise. Revenue is cash in the bank. And until your finance team is part of the RevOps conversation, you don't actually have a revenue operations function. You have a sales operations function with better branding.

The Gap Nobody Talks About

Here's what lives in the space between "Closed Won" and "Cash Collected":

Billing errors. The sales team negotiated a custom discount that never made it into the invoicing system. A proration got miscalculated. An annual contract got billed monthly by accident. According to research by Ernst & Young, revenue leakage silently eats 1–5% of EBITDA every year. For a company doing $10M in ARR, that's up to $500K walking out the door because two systems don't talk to each other.

Failed payments and involuntary churn. Your customer didn't leave because they were unhappy. They left because their credit card expired and nobody followed up. Failed payments account for 20–40% of total churn in subscription businesses. That's not a Sales problem or a Success problem. That's a Finance problem that RevOps should be catching.

Discounts that never expire. Sales offered a 30% introductory discount to close the deal. Twelve months later, that discount is still applied because there's no automated trigger tied to contract terms. Nobody in Marketing or Success is watching for this. Nobody in Finance is either, because Finance isn't in the RevOps loop.

Contract-to-billing misalignment. Sales promises one thing. Finance bills another. The customer notices before either team does. Now you've got a support ticket, an angry email chain, and a renewal that's suddenly at risk — all because the handoff from CRM to billing system was a copy-paste job into a spreadsheet.

Research compiled by the European Spreadsheet Risk Interest Group found that over 90% of spreadsheets contain at least one error. And yet, for most startups, a spreadsheet is the bridge between what Sales sold and what Finance bills. That's not a process. That's a prayer.

Why This Keeps Happening

The reason Finance gets left out of RevOps is structural, not intentional. RevOps grew up inside Sales. It evolved from Sales Ops, inherited Sales Ops' tools (Salesforce, Outreach, Gong), and inherited Sales Ops' blind spots. Finance was always "someone else's department."

This is reinforced by where RevOps typically reports. If your RevOps function reports to a CRO, VP of Sales, or even a CMO, it will naturally optimize for the metrics those leaders care about: pipeline velocity, win rates, lead conversion. Those are important metrics. They're also incomplete.

Only 37% of CFOs say they collaborate seamlessly with their Chief Sales Officer. That's not a communication problem. It's an architecture problem. When Finance and Revenue Operations run parallel planning processes — separate forecasts, separate dashboards, separate definitions of what counts as "revenue" — you get a company where the left hand doesn't know what the right hand is billing.

And the cost of that misalignment? Research suggests it can drain 5–10% of yearly revenue through duplicated effort, misallocated resources, and leakage that nobody's tracking because nobody's been asked to.

What RevOps Looks Like With Finance Inside

When we work with clients at Alternative Partners, our RevOps framework doesn't end at the signature. It follows the money.

That means the customer journey we map doesn't stop at onboarding or renewal. It extends through invoicing, cash collection, revenue recognition, and financial reconciliation. Because if you can't confirm that the revenue your CRM reports actually matches the cash your finance system shows, your ARR number is a polite fiction.

Here's what changes when Finance is part of RevOps:

Your forecasts get honest. Sales forecasting and financial forecasting become the same exercise, not two teams producing two numbers that never quite match. When your CFO and your CRO are looking at the same pipeline data with the same definitions, board meetings get a lot less awkward.

Revenue leakage becomes visible. When billing, collections, and contract management are inside the RevOps framework, you can finally see where money is falling through the cracks. You stop discovering leakage during annual audits and start catching it in real time.

Renewals get smarter. If your Success team knows the billing history — not just the usage data — they can spot risk signals that product telemetry alone won't catch. A customer who's disputed three invoices in the last quarter is a churn risk, regardless of what their health score says.

Investors trust your numbers. This one matters more than most founders realize. Investors are scrutinizing revenue quality with the same rigor they'd apply to a public company. Net revenue retention, LTV:CAC, burn multiples — all of these metrics depend on clean financial data flowing into your revenue reporting. If your RevOps stack can't reconcile with your books, sophisticated investors will notice. They just won't always tell you that's why they went quiet.

"But Our Finance Team Uses Different Tools"

Yes. They do. That's the point.

The integration challenge is real — Finance lives in NetSuite or QuickBooks or Sage, while Sales lives in Salesforce and Marketing lives in HubSpot. The data models are different. The workflows are different. The people are different.

But RevOps was never supposed to be easy. The whole premise of RevOps is breaking down silos between departments that have historically operated independently. Leaving Finance out because "they use different tools" is the same logic that kept Sales and Marketing siloed for decades. We solved that. We can solve this too.

The answer isn't necessarily one platform. It's one framework — a shared set of definitions, a unified view of the customer journey, and a single source of truth for what "revenue" actually means at every stage from lead to cash collected.

Where to Start

If you're reading this and thinking "our Finance team isn't anywhere near our RevOps conversations," you're in the majority. Here's where we'd tell you to start:

Agree on definitions. Get Sales, Marketing, Success, and Finance in the same room and align on what counts as revenue. Not bookings. Not pipeline. Revenue. You'd be surprised how many organizations have three different answers to this question.

Map the post-sale journey. Your process map probably ends at "Closed Won" or, at best, "Onboarded." Extend it. Follow the money through invoicing, collection, recognition, and reconciliation. Document every handoff. You'll find gaps you didn't know existed.

Track revenue leakage as a KPI. If you're not measuring it, you're not managing it. Make leakage a number that someone owns — not abstractly, but on a dashboard that gets reviewed alongside pipeline and churn.

Give your CFO a seat at the RevOps table. Not an invitation to a quarterly review. A seat. If your RevOps champion comes from Sales or Marketing, their instincts will optimize for Sales or Marketing. The whole point of RevOps is cross-functional alignment, and you can't align functions that aren't in the room.

The Whole Picture

Gartner predicts that 75% of the highest-growth companies will have adopted a RevOps model by 2026. That's promising. But adoption without Finance is like framing a house and forgetting to pour the foundation. It'll look right for a while. It won't hold.

RevOps, done properly, is the holistic framework that aligns an organization's internal processes around revenue growth along the entire customer journey. The entire customer journey. That journey doesn't end when the contract is signed. It ends when the cash is in the bank, the books are reconciled, and you can say with confidence — not hope — that your revenue number is real.

That's what RevOps is supposed to do. It's time to let it.